Dynamic Containment Service: a stepping stone to a low carbon electricity system

Arenko is an energy asset optimisation and automation company using software and hardware to integrate batteries and renewables into existing and evolving electricity markets. Dynamic containment is a post-fault frequency service launched by the UK National Grid ESO (Electricity System Operator) in September 2020. This week marks the 8th week of this service being live.

Key Points:

- Dynamic Containment is the latest frequency market from the ESO to help manage the stability of the electrical system as it evolves into a sustainable, low carbon network

- Arenko is the only company to have been successful in winning each of the daily auctions and of providing the service without any unavailability or underperformance penalties since it began

- The daily auction winning prices have consolidated on a price of £17/MW/h. This is 2-3 times the price of other frequency response services

- This represents a net income of nearly £150k per MW per annum and a highly attractive return for battery owners

- The Independent Technical Expert who reviewed Arenko’s performance said the following: “About as close to 10/10 as you can get”

- The key next steps for this service from Arenko’s perspective is the vertical stacking of services alongside Dynamic Containment

Roger Hollies, Chief Technology Officer, said:

“Arenko see huge value to the ESO, and thus to the consumer, in facilitating participation of assets providing Dynamic Containment into other existing markets such as the Balancing Mechanism, in addition to future markets such as voltage support and thermal load management. This stacking has compound benefits of diversifying and increasing revenue streams for battery asset owners and in reducing total costs of balancing services for the ESO, ultimately reducing the cost to the end consumer. Arenko is excited to be on the front line of helping shape future, sustainable and low carbon electricity networks.”

Dynamic Containment: What is it?

The system that provides the whole country with electricity, the national grid, has a frequency: 50Hz. This is the speed at which the engines of that machine, the generators, are designed to rotate. As the system comes under load that engine slows down (just like a car working to go up a hill). As more generation comes on, the engine speeds back up again. This frequency signal is (nearly) instantaneous across the country, you can plug a basic power meter into a 3 pin plug anywhere and see the balance of supply and demand across the country by looking at the frequency measurement and how close to 50Hz it is. This frequency characteristic guides local generators to help balance the supply and demand on the grid by providing power or demand relative to the frequency.

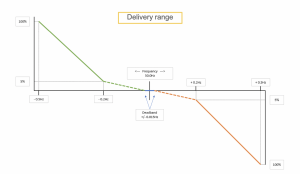

Dynamic Containment is the latest frequency market from the ESO to help manage the stability of the electrical system as it evolves into a sustainable, low carbon network. As a relatively islanded grid with a growing percentage of our power sources from renewables, the UK is taking a global lead in developing systems that facilitate a low carbon grid. Dynamic Containment is a shining example of this as one of the most advanced frequency response services in the world. It is a post fault service and, for the moment, only provides low frequency response. That is, in the scenario where a large generator or an interconnector has a fault and trips off the system, there is a huge loss of power and the frequency plummets. Providers of Dynamic Containment respond very quickly, delivering lots of power into the network to help bring the system up to speed. The response is dynamic, meaning that power is proportional to the frequency: the worse the disturbance, the more power gets injected into the grid. The response is non-linear: when frequency deviations are low, the power response is shallow. But in the case of a drop greater than 0.2Hz, a stability target for the system operator, the response steepens rapidly to full power at 0.5Hz.

Graph 1 showing 2 way dynamic frequency response: % response with changing frequency. For the initial soft launch only the low frequency response is being procured as a service.

Initial power response is required between 250ms and 500ms with full power delivery occurring between 500ms and 1 second. Finally, the power must be provided within 3% of targeted response. Because of the speed and accuracy of this service, it is ideally suited to batteries. Batteries are capable of managing power to a fine level of control because their activity is managed by electronic power controllers, or inverters, which makes them capable of controlling power with extraordinary precision.

In batteries, power is managed by electronic power controllers (inverters) and capable of managing power to a fine level of control.

The Dynamic Containment service was launched on the 1st of October as a day-ahead auction for service provision in the following 24hrs. Arenko is the only company to have been successful in winning each of the daily auctions and of providing the service without interruption since it began.

This service pays a big reward for high performing assets

The daily auction winning prices have consolidated on a price of £17/MW/h. This is 2-3 times the price of other frequency response services. This represents a net income of nearly £150k per MW per annum and a highly attractive return for battery owners. It is important to point out that this still represents excellent value for the ESO, the price is capped at a level that is less than the cost of the alternative action, that is what else the ESO would have to do to maintain the levels of stability they require. It is an interesting development for battery owners as this revenue stream is valuing fast and precision control with high-resolution data provision as appose to the alternative trading strategy where value is largely driven by optimisation of trading strategies. For Arenko we see the real opportunity is being able to combination both, we come back to this vertically stacking markets later.

So why is Dynamic containment so valuable? In post fault management, quicker is better: the sooner power can be dispatched to support the network, the less total power is required to resolve the issue. Imagine knocking over a heavy marble statue: if you catch it early, it is easy to keep upright, but try to catch it once it has gained momentum and you’ll need a lot of power to keep it upright. What happens if we let this statue fall over? Blackout: loss of power across large areas of the country. This is what happened in August 2019.

It is expected that these high prices commanded by early entrants will reduce as new providers enter the market and ESO’s demand for this service is satisfied, but this is not happening quickly. The ESO have an initial requirement of 500MW, increasing to 1GW next year. At the moment, less than 300MW are bidding. This is because the service is challenging to qualify for and to deliver.

The pre-qualification tests are hard

Arenko are world leaders in understanding and controlling batteries and these tests represent the most challenging qualification and delivery criteria the Company has come across. Furthermore, Arenko believe them to be the most stringent criteria of any service in which batteries can participate globally. The two key difficulties are:

- Timing the response: 500ms for an initial response is pretty easy for a battery. If tuned properly with rapid control loop interfaces, batteries can have power at the meter in less than 100ms from a power signal. What made this difficult was the limit on being too quick across a range of target power. In order to deliver both full power and down to 5% of full power to the same timing limitations, Arenko had to use a narrow range of ramp rate and initial response delay with very little margin for error.

- Response accuracy at low power. Again, accuracy to within 3% of nameplate power is easy for software defined power control. However, that same tolerance was applied to full power and down to 5% of nameplate power. 3% accuracy on 5% of nameplate power is requesting power with a tolerance of 0.015% of system nameplate power

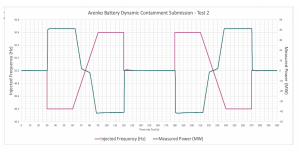

See the graph below showing the results of test 2: the ramp test. Pink is injected frequency and green the power response. You can see the response elbow showing the low power response at low deviation.

Graph showing the results of Dynamic Containment Prequalification test 2: Ramp test

That said, Arenko made it through qualification and submitted its test results. The Independent Technical Expert who reviewed Arenko’s performance said the following: “About as close to 10/10 as you can get”. Asset owners are taking notice: Arenko is working with several who are seeking to ensure that their assets can participate in this lucrative market.

There’s lots of data

Due to the speed of response required, this service is controlled locally (at the battery) on very quick control loops. In order to understand that providers are correctly delivering this critical service the ESO requires two data flows.

- Operational Metering data is provided every second, direct to the ESO control room for a live view of what assets are doing: This data contains critical parameters such as measured frequency and delivered power at the meter.

- Performance Reporting data must be provided with a similar set of data but measured at 20Hz resolution. This data is batched up and submitted every hour of service delivery.

This is a lot of data: Over 1.7 million data points a day or more than 50 million data points for the month of October alone. There are very clear and well laid out performance calculations that use the data provided so there is no hiding underperformance. Penalties for non-delivery are punitive as befits a critical service such as this. These data provisions must be fully automated and are thus are ideal for a vertically integrated platform like Arenko’s. The assets under Arenko’s control are performing exceptionally well: 100% availability and zero penalties for underperformance. Some statistics: Arenko’s average deviation from target power is 0.02% and the maximum deviation the Company has seen 0.9%. Penalties start at 3% deviation and a single data point of more than 7% deviation causes a zero payment penalty for the service period.

Rebalancing the rebalancing asset

As mentioned above, the service is a one-sided, low frequency response only, which means Arenko is only discharging power. To be available for this service, the asset must always be able to provide 15 minutes of contracted power. The service must be delivered continuously over 24 hours so to stay in for an entire delivery period, assets must manage their state of charge (SOC). The service allows rebalancing power, however these charging schedules must be done in half hour blocks and communicated to the control room at least an hour ahead of time. Initially, Arenko set up a simple automation logic with a target SOC that would automatically schedule the required charge volume if Arenko dropped below a certain SOC. Arenko has now started to optimise this charging based on pricing opportunities in order to minimise the cost of the energy used to deliver the service. Arenko has already seen 1-2% net revenue increase due to this early optimisation. The first weekend in October, Arenko was paid to charge the system by targeting negative price periods for the rebalancing. This is the dream, and a form of stacking. Negative prices are a sign that there is too much power on the grid and a market signal for participants to take power—Arenko is providing two services to the grid at once. As flexible assets, batteries can respond to this signal and support the network. Even whilst delivering a critical service like Dynamic Containment.

Technically difficult but physically easy

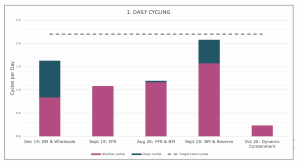

Whilst the response, rebalancing and reporting requirements of this service have their technical challenges and their value is inarguable, assets delivering Dynamic Containment are just not used that much! For the majority of the time, grid frequency deviations are low (the system is not in fault) and because of the shape of the Dynamic Containment response curve, the necessary power volumes are low. This means the batteries charge and discharge, or cycle, very little. Since the start of this service delivery Arenko is seeing an average of 0.23 cycles per day. See graph below of how this cycling compares to previous months when Arenko has been active in combinations of other markets. As you can see even compared to the Sept 19 month in pure FFR the cycling is very low and way below the warranty-linked target of 2.2 cycles per day. It is also worth noting that all the cycling is shallow cycling. Here we define shallow cycling as single charge/discharge actions that account for less than a 50% change in SOC: it’s a simple metric that separates the short, sharp power cycling from the more long high power actions that, for the majority of modern battery chemistry causes slightly more ‘wear’ to the battery cells . The battery is designed to do an even split of both types so again this demonstrates how, in terms of cycling, Dynamic Containment is gentle on the battery and importantly how much cycling capacity there is left for the battery to be doing other things.

Graph showing the average daily cycling of a battery asset for months if different markets

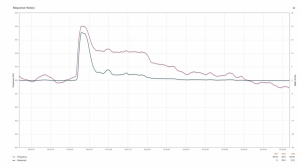

It’s an important service that has already proven its worth

Since the start of the service there have already been 3 major system events in which grid frequency rapidly moved to outside the 0.2Hz range. An example of these events, occurring on Friday 3rd October, is shown in the graph below. The graph shows the grid frequency (pink) and the asset response (green). This frequency deviation was caused by a fault that caused an interconnector with France to drop 1GW of power off the grid instantaneously (3% of the system at that time). The asset delivered a near-perfect sub-second response and helped the ESO stop and reverse the frequency deviation in seconds. In the end, Arenko helped bring the system back to normal within two minutes of the fault.

Graph showing frequency and response power during system event 3rd of October.

Next steps

Arenko is ready to go with the two-way service (up and down) once the market comes online, and the Company are continuously working to bring more assets into the service and optimise delivery. The key next steps for this service from Arenko’s perspective is the vertical stacking of services alongside Dynamic Containment. As mentioned above, batteries in this service are not used much in terms of cycling. Batteries, if designed and controlled correctly, are incredibly valuable assets capable of providing a variety of services at once. Arenko see huge value to the ESO, and thus to the consumer, in facilitating participation of assets providing Dynamic Containment into other existing markets such as the Balancing Mechanism, in addition to future markets such as voltage support and thermal load management. This stacking has compound benefits of diversifying and increasing revenue streams for battery asset owners and in reducing total costs of balancing services for the ESO, ultimately reducing the cost to the end consumer. Arenko is excited to be on the front line of helping shape future, sustainable and low carbon electricity networks.