We are pleased to have produced an article in cooperation with Ashurst discussing how the recent COVID-19 crisis can actually offer us insights into a more sustainable future in which battery storage plays an integral part in enabling a high renewable energy generation mix. We believe AI software controlled battery storage assets and other dynamically priced smart energy systems like smart EV Charging will enable high renewable energy penetration rates and an accelerated energy transition.

Foreword from Antony Skinner, Global Co-Head of Power & Utilities (EMEA & US):

In a pre-COVID-19 world, the energy transition was at the forefront of the minds and policies of governments, corporates, developers and investors. For the last two months, everyone has been focused on COVID-19 and how to overcome its challenges and mitigate its impact. James Mills, Board Member at Ashurst battery storage client Arenko Group, discusses in this article whether COVID-19 has demonstrated how renewable energy and battery storage can generate a significant proportion of energy supply and could help pave the way to a more sustainable future.

Foreword from Nick Elverston, Global Co-Head of Digital Economy Transactions:

Social distancing and lockdowns have shown us the importance of digital technology and the need to keep it powered. Our clients Arenko are an exciting business, leading the way in the digital transformation from an asset based to a software and platform based business whilst demonstrating how intelligent technology will play a key role in the renewables revolution. We established our Digital Economy team precisely to assist with those transitions.

Without diminishing the obvious human and economic cost of the COVID-19 crisis, the unprecedented global pandemic also offers a unique opportunity to imagine a more sustainable future. It provides ‘insights’ into sustainability in the broadest sense of the word, across a variety of economic and social spheres. This includes a reappraisal of supply chain robustness, addressing the resilience of excessively leveraged balance sheets and a discussion around the true value of essential workers, after a decade of stagnant wage growth. A broader theme is also the shift in global government policies towards fiscal stimulus as a response to the crisis, which invites an examination of a more sustainable approach towards infrastructure and energy transition spending.

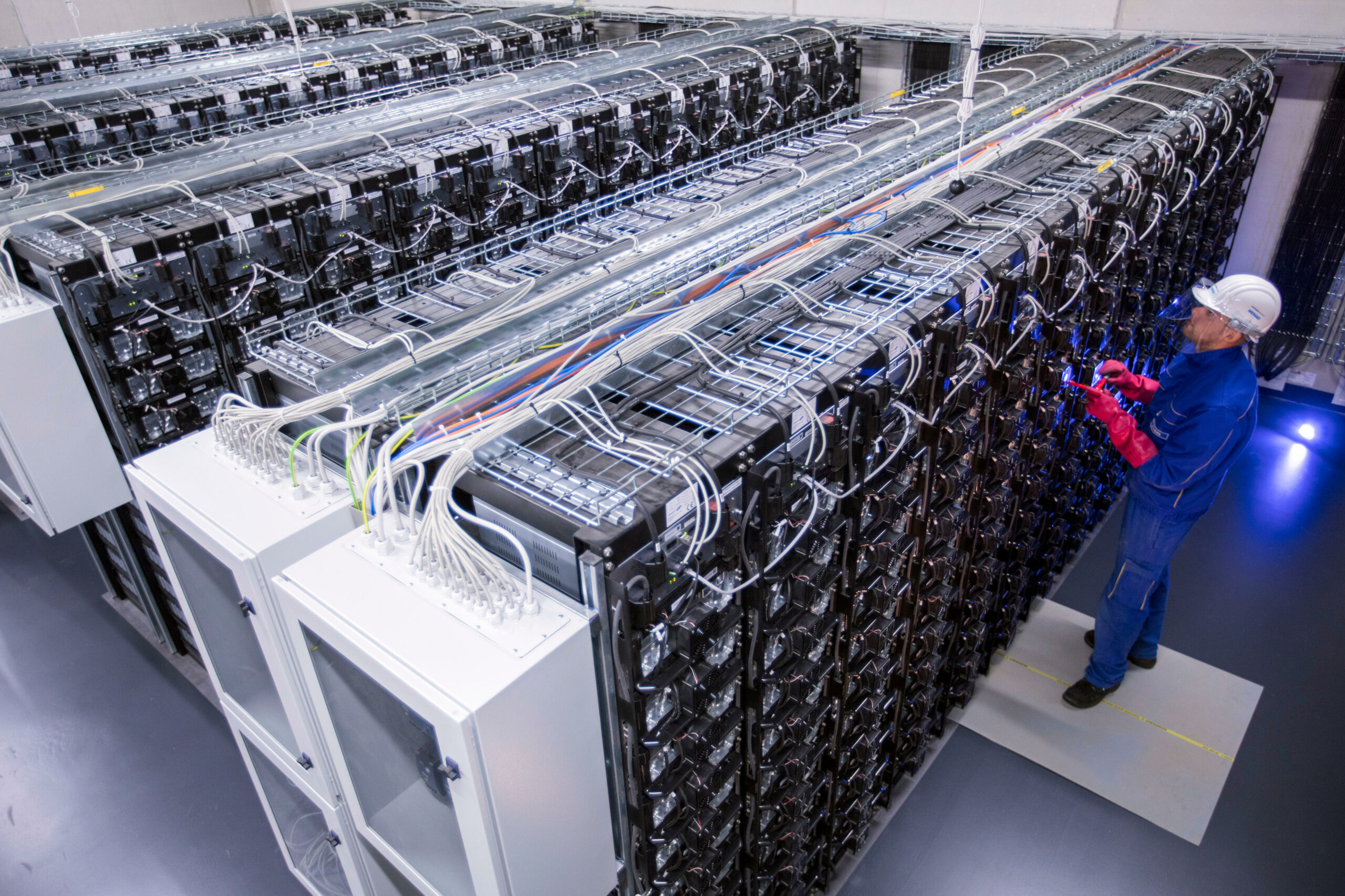

From the perspective of Arenko Group, who provides a market leading software platform for battery storage assets, the crisis offers specific insights into how we can implement and accelerate a more sustainable energy transition in the coming years. Specifically, two central elements of the energy transition are worth examining in this context: the increased penetration of renewable energy generation and the electrification of the transport sector.

Most strikingly, the UK and to a broader extent Europe and the US, have experienced a test at national scale of the ability to cope with higher levels of renewable energy penetration. An immediate impact of the crisis was a significant decline in electricity demand, linked to a dramatic economic contraction. Arenko and market observers estimate this reduced UK power demand by up to 15% in the immediate aftermath of the March lockdown1. Similar levels of demand destruction occurred across Europe and in specific US power markets such as NYISO and CAISO and intensified through April, albeit with the timing of Easter complicating annual comparisons2. In the context of strong wind and solar production, this demand destruction caused renewables to increase their share of overall power generation.

Renewables had already generated a record 36.9% of the UK’s electricity throughout 20193, but the crisis created conditions in which renewable output peaked at a new record penetration rate of 70% on Sunday 5th April. This stress test of the UK’s capacity to cope with high renewable penetration rates suggests that National Grid is well positioned to meet its commitment to run the grid on a 100% net zero carbon basis by 2025. With the UK government committed to quadrupling offshore wind to 40 GW of capacity by 2030, in a market that has recently seen off-peak demand fall to 20GW, the outlook for a more environmentally sustainable and ultimately zero carbon generation mix looks increasingly positive.

Two other sustainable generation insights created by the crisis are; increasingly frequent negative short term power prices and a dramatic decline in daily average prices. Since the end of 2019, a couple of negative power price events have occurred in the UK’s physical half hourly balancing market, but the frequency of these events rapidly increased after the lock down. Multiple repeated negative price settlements were experienced, as the system coped with higher levels of intermittent renewable energy and significant changes in demand patterns. This impact was also felt in the day ahead futures markets, which recorded highly unusual negative pricing. These negative prices highlight the difficulties higher renewable penetration can create when stabilising an electricity grid. However, they also signal the role that dynamic pricing will play in incentivising battery storage, demand side management and most importantly, intelligent EV charging. At Arenko, our fully autonomous software platform was able to provide flexibility and rapid charge and discharge instructions during the crisis, to help reduce price volatility and enable higher rates of renewable power generation. This price volatility signals the future revenue potential for battery storage assets and shows EV owners a sustainable, renewable energy future should offer low or even negative priced charging opportunities.

Concerning the broader issue of falling average power prices, the 30% decline in the UK March settled price from a year ago to unusually low levels of £29MWh, was mainly driven by demand destruction4. However, it also highlighted a clear long-term trend across global electricity markets, where rising renewable penetration rates have driven down wholesale power prices, due to the collapsing capital costs and zero marginal costs of renewable power. In particular, utility scale solar and wind generation costs now significantly undercut gas power generation and dominated 72% of global power installations in 20195. The crisis thus demonstrates that high renewable energy penetration rates are technically possible and will require dynamically priced demand management and storage solutions. In return, renewable energy will offer consumers structurally lower prices and opportunities to benefit from smart intra-day pricing strategies, whether in residential and industrial heating markets or the transport sector.

It is not only low electricity costs that will drive the electrification of the transport sector, but also the drive to reduce air pollution, especially in urban centres. It is here that the crisis offers a more intangible, if no less powerful insight into a more sustainable future. A key problem with shifting to an electrified transport system is that the current system’s true costs, or environmental externalities, are hidden from consumers, especially the impact of particulate and NOx air pollution. For most people, the physical health costs of air pollution caused by road and airline transportation only emerge gradually over time, but are still often deadly in their ultimate impact. Yet at the same time, this economic health cost is not directly borne by the consumers of polluting road and jet fuel.

Already there is clear evidence of the significant improvements in air quality caused by the crisis, whether the sudden emergence of forgotten Himalayan views in Northern India and the 44% declines in particulate pollution in Delhi, or the reductions in NOx emissions across Northern Italy6. Perhaps the most comprehensive data so far has come from San Francisco, where according to local pollution consultants Aclima, an early lockdown produced extraordinary declines of approximately 40% in NOx and black carbon, 30% in fine particulate emissions and 25%-40% decreases in localised CO2 enhancements7. With the global population expected to reach 10bn by 2050, of whom 70% will be living in cities, this crisis has offered us a chance to temporarily experience for ourselves the direct pollution reduction benefits of a switch to a sustainable, fully electrified transport system. This does not diminish the challenges of deploying widespread charging infrastructure or preventing transport electrification from creating unjust affordability issues across society. However, the crisis allows us to step back from our existing hectic levels of urban living and clearly experience the pollution and health benefits of an electrified Energy Transition.

The final element of the crisis worth examining is whether it will accelerate sustainable infrastructure investments by governments and individuals, as fiscal stimulus strategies become more accepted politically. Prior to the crisis, policy makers across the EU and the US had started promoting ‘Green New Deal’ spending policies8. With their classical Keynesian deficit spending mentality, these policies ran counter to recent orthodox thinking around budget deficits and austerity economics. However, the crisis has transformed the discussion overnight, with an almost universal acceptance that monetary policy can no longer provide a sufficient stimulus response to the crisis and that massive fiscal stimulus is required. In this context, it seems likely governments will direct much of this fiscal stimulus towards more sustainable infrastructure spending and industry support packages, especially those that create more robust and self-sustaining energy systems.

To a lesser degree this focus on robust and sustainable energy systems may also accelerate at the consumer level. The leading residential solar market of California had already seen a dramatic acceleration in residential battery system installations prior to the crisis. Primarily due to growing wildfire related blackouts, 40% of all new solar systems had residential batteries specified and analysts expected 2020 to show a 400% increase in battery installations9. With the crisis accentuating a focus on home working and domestic power resilience, it is likely consumers will accelerate further their domestic renewable generation and storage capabilities and take greater control over the sustainability of their own energy consumption.

In summary, the COVID-19 crisis has given us an insight into how we can transition to a more sustainable, low carbon future and is likely to accelerate the significant investment needed to decarbonise our economy. This will result in high renewable energy penetration rates feeding a less polluting and electrified heating and transport system, and hopefully occur in the context of a broader re-appraisal of how we create a more sustainable future.

Author: James Mills, Board Member, Arenko Group

Full Link: https://www.ashurst.com/en/news-and-insights/insights/arenko-guest-article—the-covid-19-crisis-offers-insights-into-a-more-sustainable-future/