PART 1: CONVENTIONAL RESERVE

The ESO uses the balancing mechanism (BM) to manage electricity demand and supply while managing a variety of issues (energy, inertia, voltage, constraints, reserve etc). Here, I will focus only on how the industry currently meets the need for reserve and explain the opportunity for doing it in a cheaper, cleaner, more flexible way.

What is reserve?

Reserve is needed to ensure that the ESO can call upon assets to increase or decrease power output to balance any unexpected changes in demand or supply. It’s an important part of securing the system and is essentially used to manage forecast error margins or unexpected outages; kind of like a substitutes bench, or insurance policy. The size of the need is complex to calculate, but according to the newly available data in the ESO data portal – the need for positive and negative reserve is typically between 1-2,000MW up and down, and can be up to 3,000MW each way.

How does it work at the moment?

Combined cycles gas turbines (CCGTs) typically incur a large start-up cost to fire up, and have to stay on for a long period of time. This large start-up cost can be spread over a longer time period in order to make the marginal cost of power competitive. The principle also applies to reserve, where the large start-up cost is still incurred, but the CCGTs are operating at a reduced power output to provide upwards and/or downwards flexibility. One catch is that to access this reserve, the CCGTs have to be ‘positioned’ and kept on for hours at a time, even if they are only needed for a short time.

When CCGTs are already on, the large start-up cost becomes less influential. Therefore, given the low additional marginal costs of providing the output, CCGTs can be a very competitive option to balance the system. However, in high renewables & low national demand situations (i.e. the summer of covid-19), CCGTs are often lower down the economic merit order and therefore not running at all.

Indeed, due to the increasing volatility of the system, it is almost impossible for the ESO to make optimal commitments by bringing CCGTs on a 4-6 hour run. Especially if the outturn is up to 3000MW away from forecast.

What if there is not enough reserve?

The answer is usually firing up CCGTs ahead of time, but this comes with consequences. Firstly, the payment for providing reserve is technically attributed to the ‘positioning energy’ which is not the bit that is necessarily needed. Secondly, if the system is already balanced, the extra ‘positioning energy’ has to ‘go’ somewhere – either by paying to reduce generation or increase demand.

This is odd when you think about it. Why pay for the part of a service you don’t need, and then pay to get rid of it again… rather than just pay for the bit you do need? Nevertheless, it has been the only option available to the ESO and is a consequence of the current market arrangement and the limitations of a technology that must be halfway ‘on’ to provide flexibility.

We have seen this situation happen with increasing frequency where, at times, the best option to secure reserve appears to be turning down low carbon nuclear and renewables and exporting power over interconnectors, sometimes at a loss to Europe, whilst bringing on CCGT assets to provide reserve. None of this is consistent with Net-Zero and clearly we need better options to be available to the ESO, particularly when better options are available today through batteries.

Why is this a problem?

All this manoeuvring ahead of time can make the BM less dynamic and reduce the inherent volatility that other technologies, like batteries, are well placed to manage.

It’s like paying to lease a second car in case your first car breaks down. The cost also includes paying for parking and leaving the engine running for a quick getaway. It technically works and provides peace of mind, but it is more expensive than just getting a Zipcar if and when you need it. I’m not even going to mention emissions.

This effectively denies batteries a fair share of the ‘balancing pie’ as it were (Zipcar wouldn’t even get a look-in if you already committed to that second car). So, we jumped at the chance to respond to the ESO’s request for new ideas about flexibility services. We wanted to show that not only could batteries technically provide this service, whilst bringing technology-specific advantages of speed and flexibility.

PART 2: DYNAMIC RESERVE:

The principle of batteries being more commercially competitive to provide reserve is a simple one, in that they do not need to be ‘on’ to provide reserve, so inherently the costs and emissions should be lower. That is before having to account for any offset actions required to offset the ‘positioning energy’ when there is no need for this excess energy.

The more difficult practical challenge was proving that batteries could be relied upon to provide sustained reserve. If we could prove this, then batteries could be legitimately planned and paid for ahead of time. This could increase effective competition for CCGTs, and in turn, help drive down emissions and balancing costs for the end consumer.

What was the proposal?

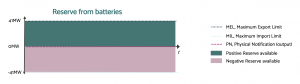

We approached this challenge from a different perspective. Firstly, rather than thinking uniquely in energy capacity terms (if the battery is empty, it’s useless), we preferred to think in power terms. To be specific, the 41MW Bloxwich asset always has 82MW of power available, even when no power is flowing at the meter. With this new perspective came new insight.

This section illustrates, in principle, how it is possible to maintain sustained negative reserve with a 1-hour battery. I will run through negative reserve only (i.e. charging the battery), but the inverse applies for positive reserve too.

SOC: State of charge of a battery.

PN: Physical Notification; the planned charge/discharge schedule of the battery, which the ESO can change through instruction

State A:

- SOC:0%(batteryempty)

- PN:0MW

When the battery is at 0% SOC, a 1h battery has approximately 1h10m of negative reserve available at 41MW. If this is not utilised, the battery will continue to provide 41MW of negative reserve indefinitely without any active power on the system (unlike conventional plant that would need to be ‘positioned’). However, if it is used, the SOC will move towards State B…

State B:

- SOC:100%(batteryfull)

- PN:0MW

If the battery reaches 100% SOC, the battery is full, but it can still provide negative reserve by moving to state C via a ‘positioning BOA’. In practise, the aim would be to position the battery before ever reaching state B.

State C:

- SOC100%(batteryfull)

- PN:41MW(dischargefor1h)

From 100% SOC, with a 41MW discharge PN, the battery is discharging but can still provide negative reserve at 41MW for 1h. The net power at the meter would actually be 0MW in this case. At the end of this period, the battery will revert to State A (providing 41MW of reserve for 1h10m).

These ‘states’ demonstrate sustained negative reserve, no matter the SOC. However, in practice, the aim would be to move between these states and maintain the asset in the middle SOC range and to provide even more reserve as per State D, below.

State D (Boost):

Ahead of utilisation, ‘Positioning instructions’ can be used to effectively double our negative reserve during times of particularly high requirements (a 41MW discharge gives 82MW negative reserve). This can be over an hour, or for a short duration of a couple of minutes as the system needs it. To quote Laura Sandys – this would help us ‘manage the peak’ not simply ‘meet the peak’.

The ESO can therefore plan the requirement for positive and/or negative reserve at very specific times – significantly undercutting the overall ‘positioning costs’ of CCGTs. This shows that batteries can provide reserve that is dynamic in time, size, and direction. In some ways, this addresses a weakness of batteries (duration) and flips it into a strength.

PART 3: SO HOW DID IT GO?

Arenko conducted two trials with the ESO to try to prove this capability for the control room and now the ESO has decided to take it further and conduct an expanded trial with more batteries in September. We think trials and learning by doing are a great way to innovate and would like to thank all those who worked on this trial, both from the ESO and Arenko. You can read more about the second trial here

Facts & figures

Some quick highlights of what we achieved in the second trial include:

- 1GWh physically delivered in one week

- 100% instructions dispatched correctly

- Autonomous nomination and denomination

Reserve from batteries was seen to be a cost-effective alternative to CCGT’s across 106h out of 160h during relatively normal market conditions, at £15/MW/h equivalent

We had a particularly exciting Monday morning where we provided 5.5 hours at full power, continuously, from a 1- hour duration asset. Perhaps we’ll blog on that too…

In summary…

Batteries have already dominated the frequency markets in just a couple of years and as an industry, we are fast approaching an inflection point. In the UK we now have the stability pathfinder, distributed black start, the new NOA and reactive power tenders emerging. This truly is an exciting time for batteries.

What we need now is a level playing field and a clear price signal to help stimulate the much-anticipated investment in batteries, really scale the industry and offer further benefits to the ESO and consumers in the future. Initially, paying for and accessing reserve from batteries will provide a much more flexible and cost effective tool for the ESO to manage this increasing volatility. This trial is helping to open up the reserve market to increased competition. This will help batteries, especially longer duration batteries, to truly compete with CCGT commitments in the mid-merit of the electricity market.

I hope the storage industry will come together, collaborate on this September trial to achieve the scale necessary to compete with CCGTs. To that end, if any asset owner or software provider wants to be involved in the September trial and needs a hand, we want to help. Please get in touch via hello@arenko.group.